Dubai Candidate Privacy Notice

In this notice, “Moelis”, “we”, “us” and “our” means Moelis & Company UK LLP, DIFC Branch. Moelis & Company UK LLP, DIFC Branch is registered at Dubai International Finance Centre…

[debug]

post_type: page

url: https://www.moelis.com/legal/dubai-candidate-data-privacy-notice/?hilite=sitepages%2FResults.aspx%2Fwww.moelis.com

filters:

Transaction

Moelis Australia Asset Management’s acquisition of Redcape Hotel Group Pty Ltd

READ MOREE.U. Candidate Notice

CANDIDATE DATA PRIVACY NOTICE In this notice, “Moelis”, “we”, “us” and “our” means Moelis & Company London Limited, Moelis & Company London Limited is registered at Condor House, 10 St…

[debug]

post_type: page

url: https://www.moelis.com/legal/eu-candidate-notice/?hilite=sitepages%2FResults.aspx%2Fwww.moelis.com

filters:

News

Group develops proposed amended structure for ABCP MAV2 Notes to allow for redemptions

A group of institutional noteholders (the “Group”), for which Moelis & Company LLC (“Moelis”) is acting as primary financial advisor, has developed proposed amendments to the structure governing MAV2 notes…

Read MoreCA Candidate Privacy Notice

…may set a minimum period for which we have to keep your personal data. Contact Us If you would like further information please address questions, comments and requests to [email protected]….

[debug]

post_type: page

url: https://www.moelis.com/legal/ca-candidate-notice/?hilite=sitepages%2FResults.aspx%2Fwww.moelis.com

filters:

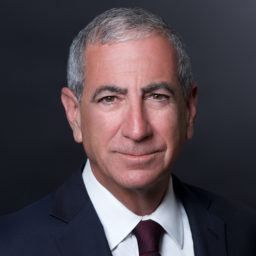

Senior Team

Ken Moelis is the Founder and Executive Chairman of Moelis & Company. Ken has over 40 years of experience both as an investment banker and an executive during which he has been responsible for the innovation and growth of investment banking franchises across the industry. He served as Moelis’ Chief Executive Officer from its founding through September 2025.

Prior to founding Moelis & Company, Ken was President of UBS Investment Bank and previously the Head of Corporate Finance at Donaldson, Lufkin & Jenrette. He began his investment banking career at Drexel Burnham Lambert.

Ken holds a B.S. in Economics and an M.B.A. from the Wharton School at the University of Pennsylvania. He is a member of the Business Council and the Business Roundtable and currently serves on the Wharton Board of Advisors and the Ronald Reagan UCLA Medical Center Board of Advisors. Ken is also serving on the Board of Directors for the Los Angeles 2028 Olympic and Paralympic Games. He was formerly Board Chair and Director of the Tourette Association of America and served on the Board of Trustees at the University of Pennsylvania for 10 years.